How to Secure Land for Your Dream Home in NZ: Essential Tips for Success

By

Trent Bradley

·

9 minute read

By

Trent Bradley

·

9 minute read

Finding and securing the perfect piece of land for your new home is often the most critical step in your building journey. In New Zealand's competitive property market, successful land acquisition requires more than just finding a section you like – it demands strategic planning, thorough evaluation, and skilled negotiation.

Table of Contents:

- Understanding New Zealand's Land Market

- Essential Land Evaluation Criteria

- Legal Considerations and Due Diligence

- Financial Planning for Land Purchase

- Negotiation Strategies for Success

- Regional Insights Across New Zealand

- Working with Professionals

- Timing Your Land Purchase

- Common Mistakes to Avoid

- Related Reading: Construction Financing Guide

- Frequently Asked Questions

- Next Steps

Key Takeaways

- Land purchases require 20-40% deposits versus 10-20% for houses, with additional $5,000-$15,000 in due diligence costs for soil testing and surveys

- LIM reports reveal critical information on zoning, flood risks, building restrictions, and planned infrastructure—never purchase without one

- Rural sections may need $20,000-$100,000+ for infrastructure (septic, water bore, power extensions) before building can commence

- Building covenants in subdivisions can mandate architectural styles, minimum build costs, or material restrictions—verify before purchasing

- North-facing sections maximize solar gain in NZ's climate, reducing heating costs by 15-30% compared to south-facing properties

- Conditional offers with soil testing, geotechnical assessment, and building consent pre-approval clauses protect you from expensive surprises

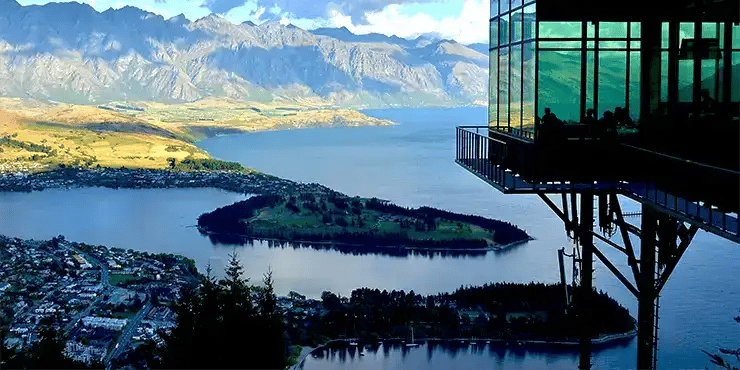

Whether you're searching for a lifestyle block in Canterbury, a suburban section in Auckland, or coastal land in the Bay of Plenty, understanding the key principles of buying land in NZ can mean the difference between securing your dream location and missing out to more prepared buyers.

The land you choose will impact everything from your building costs and timeline to your family's daily life and long-term investment returns. Getting this foundational decision right sets the stage for a successful building project and years of satisfaction in your new home.

Understanding New Zealand's Land Market

Current Market Dynamics

New Zealand's land market varies dramatically across regions, with factors like population growth, infrastructure development, and local zoning regulations creating distinct opportunities and challenges in different areas.

Urban areas like Auckland, Wellington, and Christchurch often have limited land availability, driving competition and prices higher. However, these locations typically offer better access to employment, schools, and amenities. Rural and lifestyle markets may offer more space and affordability but require careful consideration of access, services, and future development potential.

Understanding these market dynamics helps you identify realistic opportunities within your budget and timeline while avoiding areas where competition consistently pushes prices beyond your means.

Types of Land Available

Residential Sections: Fully serviced lots in established or developing subdivisions, typically ready for immediate building with connections to power, water, sewerage, and telecommunications.

Rural Residential: Larger sections offering more space and privacy, often requiring septic systems and potentially bore water or rainwater collection.

Lifestyle Blocks: Properties typically ranging from 1-10 hectares, offering space for animals, gardens, and rural living while still accessible to urban centres.

Raw Land: Undeveloped property that may require significant infrastructure investment before building can commence.

Each type presents different opportunities, challenges, and financial implications that must align with your building plans and lifestyle goals.

Essential Land Evaluation Criteria

Location and Accessibility

Transport Links: Consider daily commuting requirements, access to state highways, and proximity to public transport. A beautiful section becomes less attractive if your daily commute adds hours to your week.

Future Development Plans: Research local council development plans that might affect traffic patterns, property values, or neighbourhood character. That quiet rural road might become a major thoroughfare in five years.

Essential Services: Evaluate proximity to schools, medical facilities, shopping centres, and recreational amenities that matter to your family's lifestyle.

Physical Land Characteristics

Topography and Building Suitability: Steep sections might offer stunning views but could significantly increase foundation and access costs. Flat land might flood or have poor drainage. Understanding the building implications of your chosen topography is crucial.

Soil Conditions: New Zealand's diverse geology means soil conditions vary dramatically even within small areas. Clay soils might require special foundations, while rocky ground could increase excavation costs.

Sun Orientation and Climate: Consider how the section's orientation affects natural light, heating costs, and garden potential. North-facing sections generally offer better sun exposure in New Zealand's climate.

Natural Hazards: Evaluate risks from flooding, landslips, coastal erosion, or earthquake-prone areas. These factors affect both safety and insurance costs.

Infrastructure and Services

Utilities Availability: Confirm availability and connection costs for electricity, water, sewerage, gas, and telecommunications. Rural properties might require expensive infrastructure extensions.

Internet and Communication: With remote work becoming more common, reliable internet connectivity is increasingly important, especially in rural areas.

Waste Management: Understand local waste collection services or requirements for private waste management solutions.

Legal Considerations and Due Diligence

Title and Ownership Verification

Clear Title: Ensure the property has clear title without disputes, liens, or other encumbrances that could complicate your purchase or future development plans.

Boundary Surveys: Verify exact property boundaries through current survey information. Boundary disputes with neighbours can be costly and stressful to resolve.

Access Rights: Confirm legal access to your property, particularly important for rural land that might rely on easements or shared driveways.

Zoning and Building Restrictions

Permitted Uses: Understand what you can and cannot build on the land under current zoning regulations. Some rural zones have restrictions on house size, design, or additional buildings.

Height and Bulk Restrictions: Many areas have rules about building height, distance from boundaries, and maximum floor area that could affect your building plans.

Covenant Restrictions: Some subdivisions have building covenants requiring specific architectural styles, minimum building values, or other restrictions that might limit your options.

Environmental and Planning Considerations

Resource Consent Requirements: Some activities or building designs might require resource consent, adding time and cost to your project.

Heritage or Environmental Protections: Check for any heritage listings or environmental protections that might restrict development options.

Future Zoning Changes: Research potential zoning changes that could positively or negatively affect your property's value or permitted uses.

Financial Planning for Land Purchase

Beyond the Purchase Price

Legal and Professional Fees: Budget for lawyer fees, surveyor costs, building inspections, and potentially LIM (Land Information Memorandum) reports.

Due Diligence Costs: Soil testing, survey work, and engineering assessments can add several thousand dollars to your acquisition costs.

Development Costs: Factor in potential costs for site preparation, service connections, and access improvements that might be required before building can commence.

Financing Land Purchases

Deposit Requirements: Land purchases often require larger deposits than house purchases, potentially 20-40% depending on the lender and land type.

Construction Loan Integration: Consider how your land purchase will integrate with your construction financing. Some lenders prefer to finance both together, while others handle them separately.

Holding Costs: Budget for rates, insurance, and potentially interest costs while you plan and construct your new home.

Negotiation Strategies for Success

Research and Preparation

Market Analysis: Understand recent sales of comparable land in the area to establish realistic pricing expectations and negotiation positions.

Vendor Motivation: Research how long the land has been on the market and any factors that might motivate the vendor to sell quickly.

Multiple Options: Maintain interest in several properties to avoid becoming emotionally over-invested in a single option.

Effective Negotiation Techniques

Conditional Offers: Use conditions like finance approval, soil testing, or building consent pre-approval to protect yourself while securing the property.

Settlement Terms: Consider how settlement timing affects both parties. Flexibility on settlement dates can sometimes secure better pricing.

Professional Representation: Experienced real estate professionals understand local market dynamics and can identify negotiation opportunities you might miss.

Common Negotiation Pitfalls

Emotional Decision-Making: Falling in love with a property can lead to overpaying or accepting unfavourable terms.

Inadequate Due Diligence: Rushing to secure property without proper investigation can lead to expensive surprises later.

Inflexible Positions: Being too rigid on price or terms might cause you to miss good opportunities or lose properties unnecessarily.

Regional Insights Across New Zealand

Auckland Market Considerations

Auckland's competitive land market requires quick decision-making and often involves multiple offers. Understanding local council requirements and infrastructure development plans is crucial for making informed decisions.

Wellington's Unique Challenges

Wellington's topography creates unique opportunities and challenges, with earthquake considerations affecting both land selection and building requirements.

Canterbury and South Island Opportunities

Post-earthquake rebuilding has created new subdivision opportunities, while rural lifestyle blocks offer excellent value compared to northern markets.

Bay of Plenty and Coastal Considerations

Coastal properties offer lifestyle benefits but require careful evaluation of erosion risks, climate change impacts, and seasonal access issues.

Working with Professionals

Essential Professional Team

Real Estate Professionals: Agents specialising in land sales understand local market dynamics, legal requirements, and can identify opportunities matching your criteria.

Legal Representation: Lawyers experienced in land transactions can navigate complex legal issues and ensure proper due diligence completion.

Surveying and Engineering: Professional assessment of land characteristics, building suitability, and development costs provides crucial decision-making information.

Coordinating Your Professional Team

Different professionals bring different expertise to land acquisition, but coordinating their input effectively requires clear communication about your goals, timeline, and budget parameters.

Timing Your Land Purchase

Market Timing Considerations

Understanding seasonal patterns, economic cycles, and local market dynamics can help you identify optimal timing for land acquisition.

Coordination with Building Plans

Timing your land purchase to align with your building timeline optimises holding costs while ensuring adequate time for planning and consent processes.

Common Mistakes to Avoid

Insufficient Research: Failing to thoroughly investigate all aspects of potential land purchases often leads to expensive surprises during the building process.

Overlooking Future Needs: Choosing land based only on current requirements without considering family growth, lifestyle changes, or investment potential.

Budget Underestimation: Focusing only on purchase price without adequately budgeting for development costs, holding expenses, and potential contingencies.

Rushing Decisions: Market pressure can lead to hasty decisions without proper due diligence, potentially costing thousands in remediation or missed opportunities.

Related Reading: Construction Financing Guide

Continue your building journey with these essential resources:

Planning Your Build

- Should I Build or Buy a Home in New Zealand? - Evaluate whether building on your land is the right choice

- 5 Build Methods to Consider for Your New Zealand Home - Choose construction approach suited to your land type

- How to Navigate Code Compliance When Building Your NZ Home - Understand consent requirements for your section

Financial Planning

- Construction Loans vs Home Loans: Which Is Right for You? - Finance both land purchase and construction

- The True Cost of Building a House in New Zealand - Budget for site-specific building expenses

- Secrets to Budgeting Your Home Build Without Breaking the Bank - Control costs on challenging sites

- Why You Might Need a Financial Advisor When Building Your Home - Expert guidance for land and construction financing

Risk Management

- Fixed Price or Cost Plus: Choosing the Right Building Contract - Contract considerations for different land types

- Top Mistakes to Avoid When Building Your Home in New Zealand - Prevent costly land-related building errors

Frequently Asked Questions

What's the minimum deposit needed to buy land in New Zealand?

Most lenders require 20-40% deposit for land purchases, significantly higher than the 10-20% typical for house purchases. Raw land or rural blocks often need 30-40% deposits, while serviced residential sections in established subdivisions may accept 20-25%. Banks view land as higher risk than houses since there's no dwelling to secure the loan against. If purchasing land and immediately building, construction-to-permanent loans may offer more favourable deposit requirements by treating the project holistically—potentially 15-20% of combined land and build costs.

How much does soil testing and geotechnical assessment cost in NZ?

Basic soil testing costs $1,500-$3,000, while comprehensive geotechnical reports range from $3,000-$8,000 depending on site complexity. Challenging sites with suspected contamination, high water tables, or unstable soils may require $10,000-$15,000 in assessment. These costs are essential—discovering poor soil conditions after purchase can add $20,000-$100,000+ in foundation work. Most lenders require geotechnical reports before approving construction loans. Budget $5,000-$15,000 total for pre-purchase assessments including LIM reports, surveys, and soil testing.

Can I build immediately after purchasing land or are there waiting periods?

No mandatory waiting periods exist, but practical timelines depend on land status. Serviced sections in approved subdivisions can proceed to building consent immediately—potentially starting construction 2-4 months after purchase. Raw land requires infrastructure installation (power, water, sewerage access) taking 3-12 months before building. Resource consent for restricted activities adds 3-6 months. Building consent processing takes 2-4 months. Realistically, plan 4-6 months minimum from serviced land purchase to construction start, or 8-18 months for raw land requiring services.

What's a LIM report and do I really need one when buying land?

Land Information Memorandum (LIM) reports from local councils detail everything affecting your property: zoning rules, building consents, planning restrictions, flood risks, contamination, heritage listings, and planned infrastructure changes. Cost: $200-$400. Purchasing without a LIM is extremely risky—you might discover unbuildable land, expensive remediation requirements, or restrictions preventing your intended use. LIM reports reveal critical information like pending motorway plans devaluing your property, or flood zones requiring expensive building platforms. Always make offers conditional on satisfactory LIM review. This $300 report can prevent $50,000+ mistakes.

How do building covenants affect what I can build on my land?

Building covenants are legal agreements restricting what you can build, overriding standard council rules. Common restrictions include minimum floor areas (e.g., 180m² minimum), architectural styles (weatherboard only, no dark colours), building materials (no metal cladding), height limits, or minimum build costs ($500,000+). Some covenants ban sleep-outs, caravans, or certain roof styles. Violating covenants gives neighbours legal right to force removal of non-compliant structures. Always review covenants before purchasing—they're registered on the title and permanently affect the property. Covenants can prevent your dream home design or add $50,000+ to meet minimum requirements.

Next Steps: Developing Your Land Acquisition Strategy

Successfully securing the right land for your dream home requires a comprehensive strategy that balances your lifestyle goals, financial capabilities, and building timeline. While these buying land NZ tips provide a foundation for your search, developing a detailed acquisition plan tailored to your specific situation significantly increases your chances of success.

The most successful land buyers approach the market with clear criteria, thorough research processes, and well-defined negotiation strategies. They understand not just what they want, but how to identify it, evaluate it properly, and secure it effectively in competitive situations.

A systematic approach to land acquisition can save you tens of thousands of dollars while ensuring you find property that truly meets your long-term needs and building goals.

If you're ready to develop a comprehensive land acquisition strategy and understand how your land purchase integrates with your overall building financing plan, contact Luminate Finance today. Our team specialises in construction-to-permanent financing and can help you navigate both the land acquisition and building finance process to make your dream home a reality.

Ready to secure the perfect section for your new home? Success in New Zealand's land market requires the right strategy and the right financial partner. Contact Luminate Finance to discuss how our construction-to-permanent lending expertise can support your land acquisition and building journey.

Trent Bradley

Trent Bradley is a New Zealand financial advisor specializing in property-backed finance and investment consulting. With over 26 years of experience running his mortgage broking business, he has helped wholesale investors access high-yield property-backed loan opportunities. For the past 12 years, Trent has led Luminate Finance, a New Zealand finance company dedicated to connecting investors with secure property investment solutions.